How do you compete in a market where provinces and mega-cities have consumers as big as European countries? The harried classes of aspiring middle class have moved to the Middle Kingdom. It is worth pointing out that consumers expenditure explains more than 60% of US GDP; in China, it explains less than 30%. Consumption in China has a long way to go. The Economist reported a well-established piece of etiquette: 'you must let friends know when you are going overseas and take an empty suitcase.'

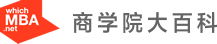

Doing business in China has all the hallmarks of game theory. Company executives become players in a game when they become aware of their mutual interdependence. To play the game in China is to understand the delicate balance between recognising the interdependence and the abandonment of unilateral action. So, management ought to know the game dimension, their competitors, small and large, and the likelihood and timing of competitor reactions. Game theory is about rational people interacting with each other in a way to achieve their own goals. It is about finding the right box for your company in the China market-as-a-game.

I think you think I think

To play the game in China, foreign executives should put themselves in the mind of their opponents, thinking like them in order to out-maneuver them in the market-as-a-game. Coming to China for some companies like Tesco in Box 3 was a disappointment while indigenous Chinese companies like Li Ning evolved from Box 1 with a position of strength and growing market share after Beijing games to a struggling player today in Box 4. For other companies like Volvo in Box 2, an opportunity presented itself as Geely acquired their engine transmission system for passenger cars, allowing Volvo to focus on trucks. Nissan in Box 1, likewise, has an interdependent relationship with Dongfeng Motors - the success of the Dongfeng alliance is Nissan's success and vice versa. Danone has taken an equity stake in Mengniu in order to maintain quality and to secure the dairy milk supply chain.

In each case cited, the companies can be described as players in the China market-as-a-game, and the art of winning in the China market is about understanding the distinction between playing to win and playing not to lose. There is a win-win outcome in Box 1 with mutual interdependence. It may be rational to try to compete independently in Box 4, but it is elusive. We refer to this as the Nash trap. In time, you will realize that it is preferable to move to Box 1 by cooperating with the competitor, forming alliances and embracing strategic alliances. There are so many small fringe players in China market in low end mobile phones, in RTDs, in retailing, wholesaling and manufacturing. In Box 4, foreign companies soon realize that if enough ants eat an elephant's foot, he topples over, eventually.

The Humble housefly

The ability of the housefly to evade our swat is a trivial matter when compared with the moves in the box but it is quite a feat for a housefly. We should acknowledge the likelihood of a pattern of action and reaction contained within the flight information and landing computations of the housefly. The sequence of swatting and evasion displays a pattern. Once we discover the pattern, a strategy that contains valuable information consistent with the sequence of moves in the game. So, if your opponent moves to Box 1, you should consider moving to Box1 too.

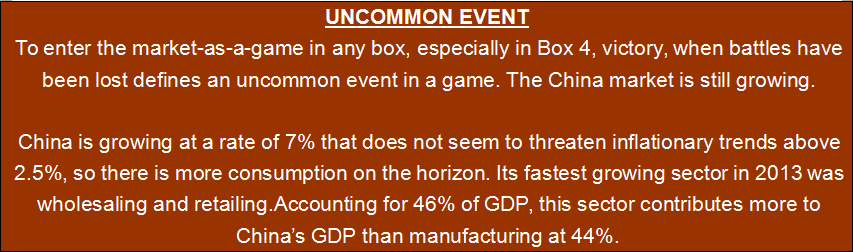

Battles lost: exit strategy

Sun Tzu, the Chinese strategist, in his Art of War advised generals on strategy. In any military exchange, the mismatch in signals, the trustworthiness of business sources, the speed of reaction, the frequency of moves, collectively impact on the player's choice of strategy. Across the battlefield, during the game, an opponent may ask: when is it time for the general to exit the game? The timing may be a function of his previous victories so he may choose to exit on the first defeat in Box 4. Foreign companies like Best Buy, Media Markt and Yahoo have exited the game in China.

Uncommon events, like declaring a victory in a game, betray the knowledge pf past actions and if the general is given new information that he did not expect, then he revises and changes his strategy. Yahoo's investment in Alibaba has reaped significant revenue rewards for Yahoo. Apple should not ignore Xiaomi or Lenovo or Coolpad or Huawei in the low end smartphones in China where an Apple 3GS is available in China via third parties in the price range 400-450RMB; a price that is twice that of brands from Lenovo and Huawei.

Thief of Nature

As China consumer in Tier 1 and 2 cities change their preferences and new opportunities arise across the supply chains and distribution channels in rural China, foreign companies, liek generals on the battlefield, ought to revise and amend their corporate strategies of doing business in China. Locate the Box for your company and plan the sequence of moves. Depending on the product range ans suite of services provided by the foreign company, a sequence of moves can be constructed to obtain a sustainable competitive advantage in the China market-as-a-game.

Rational consumers in China, urban and rural, have no idea what they want, but whatever it is, they want it now. So expectations are dangerously high, matching them with low or high prices may be an optimal response. Judicious pricing policies may facilitate a winning strategy.

However, the convergence of technology and changing consumer preferences will trump the key players as competitors from anywhere in China emerge at any time and enter the game. As Confucius said, 'when it is obvious that the goals cannot be reached, don't adjust the goals, adjust the action steps.' So chose your Box carefully and plan a sequence of moves. If you don't, a competitor will.